Following are the steps to apply for GST Registration on the GST portal:

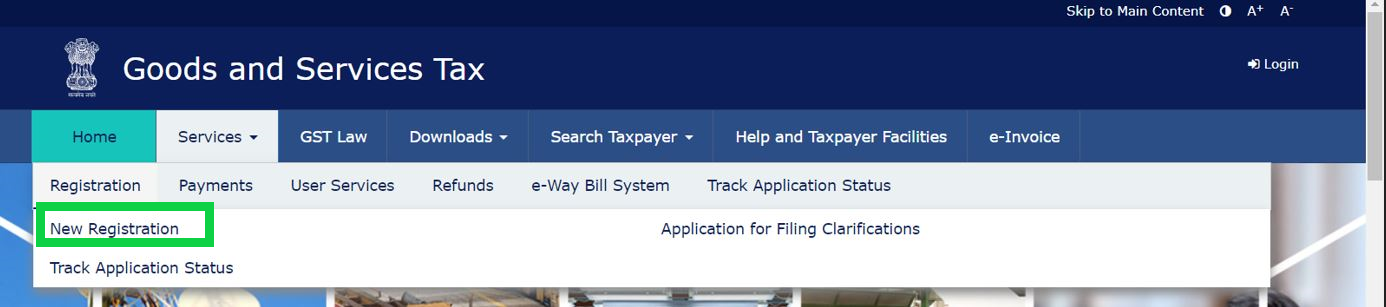

Step 1: Go to GST portal https://www.gst.gov.in/ and navigate to Services >> Registration >> New Registration option

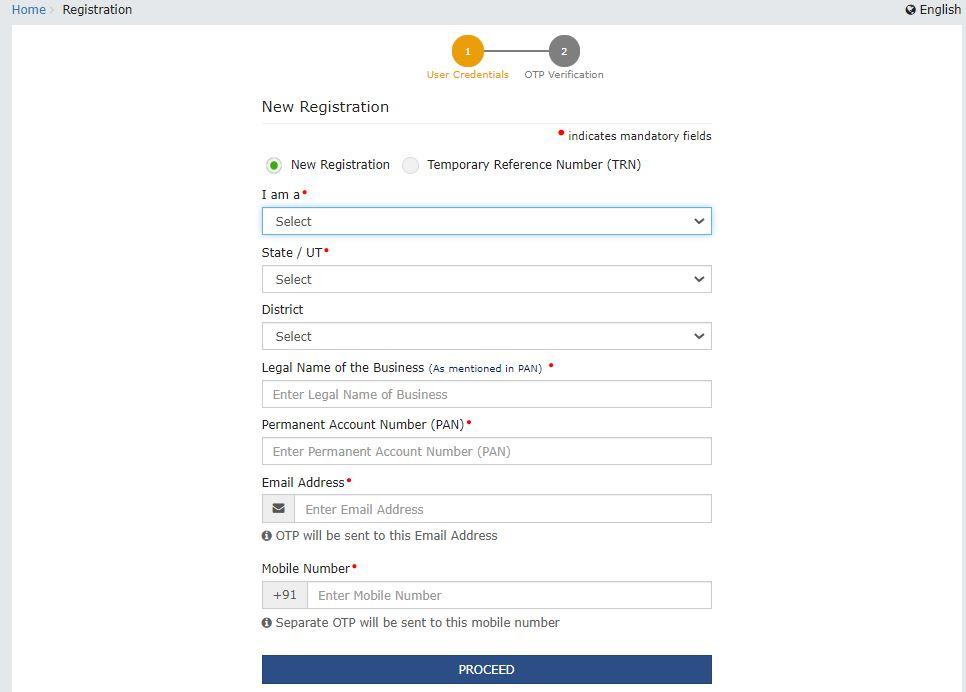

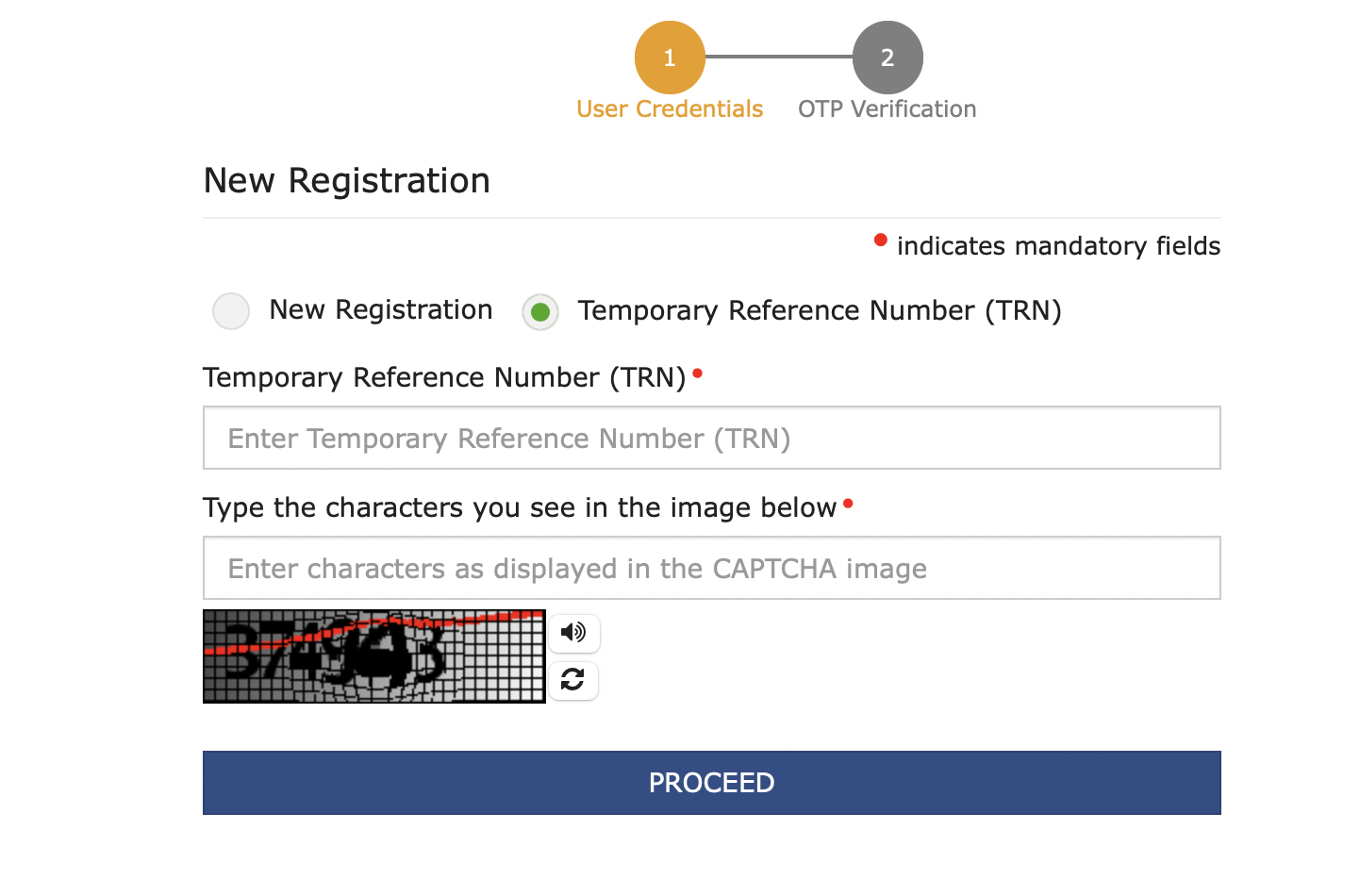

Step 2: Generate a Temporary Reference Number (TRN) by completing the OTP validation.

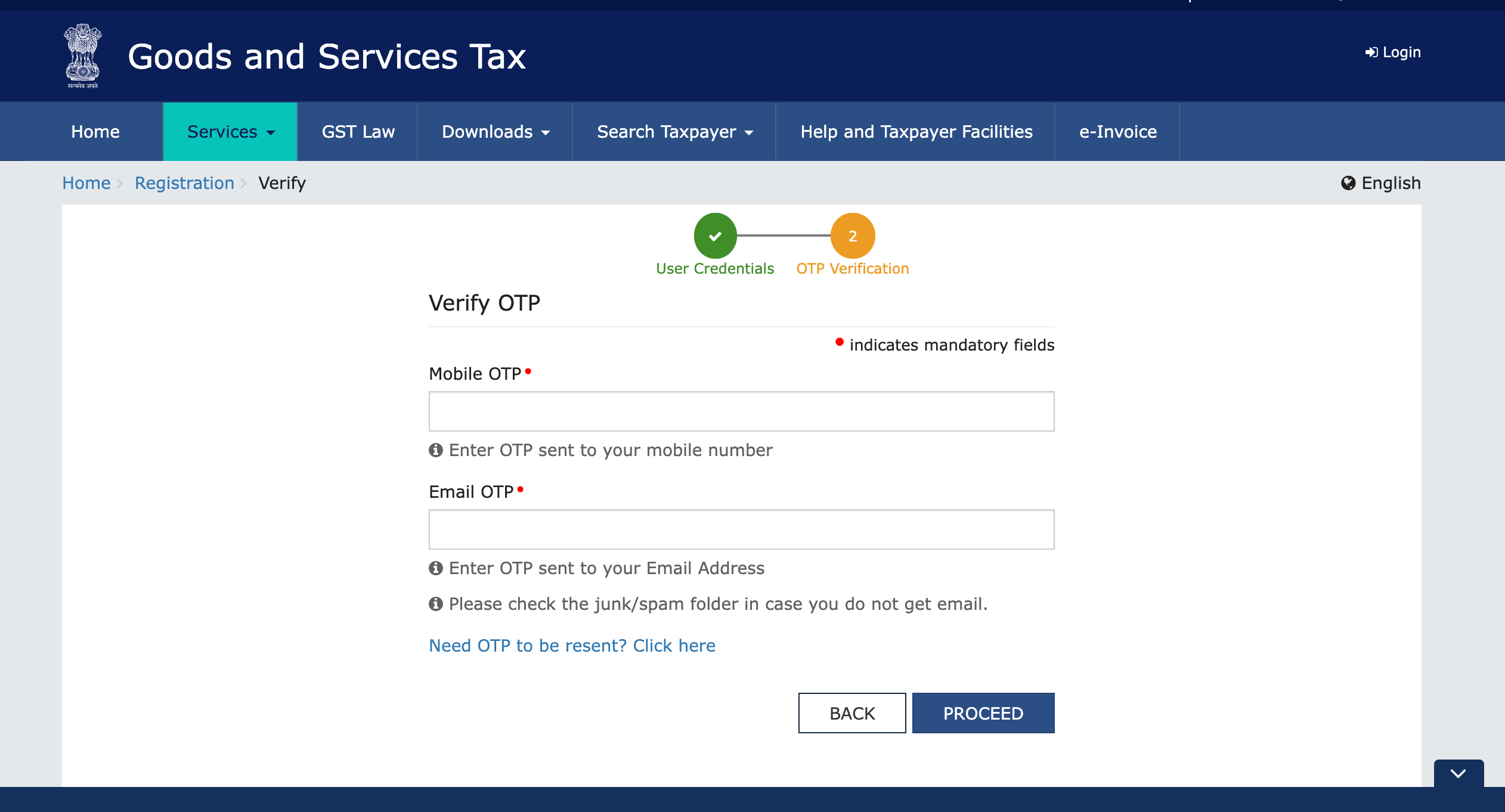

Step 3: Verify the OTP received on your registered mobile number and registered Email id. Enter both the OTPs separately within 10 minutes from receiving them.

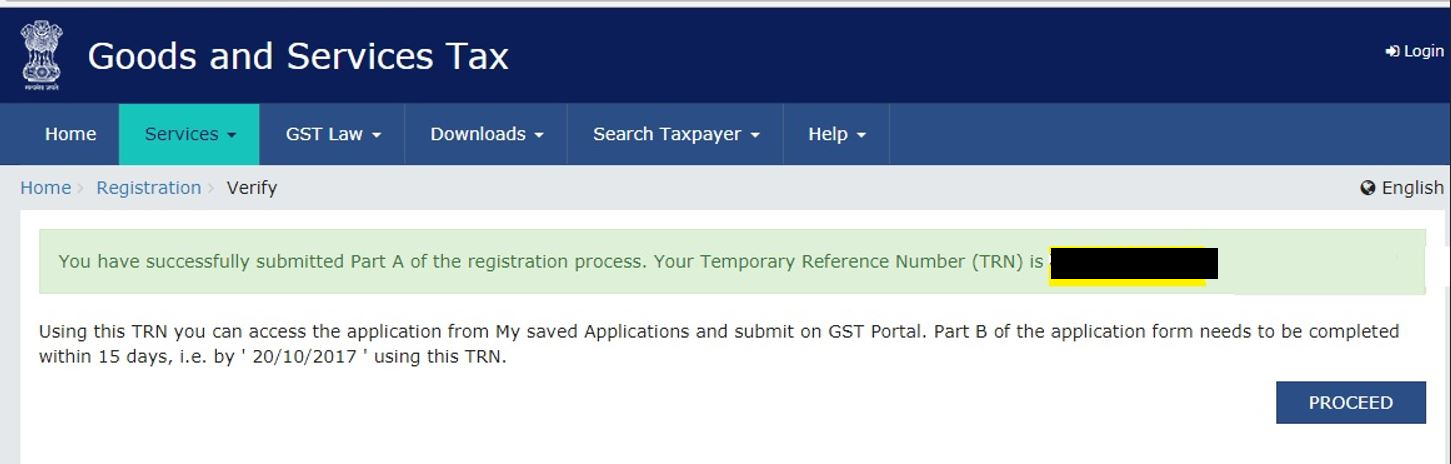

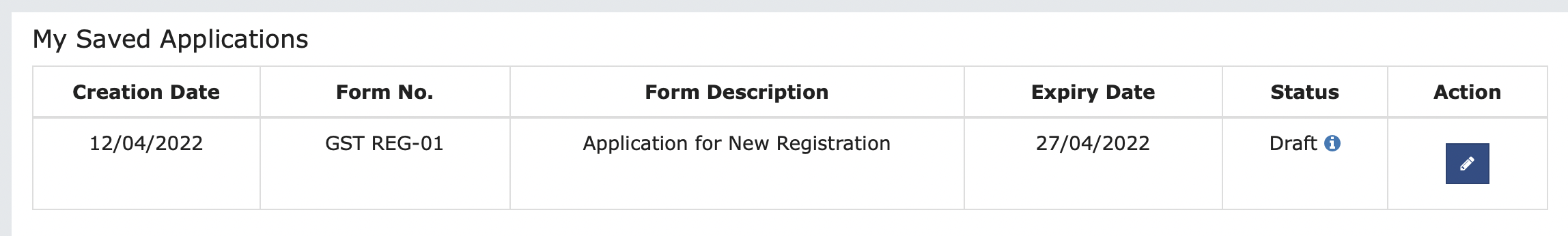

Step 4: TRN now gets generated. This TRN will now be used to complete & submit the GST registration application.

Step 5: Login to the GST portal using your Temporary Reference Number. Complete the OTP verification as prompted using your registered mobile number & E-mail id.

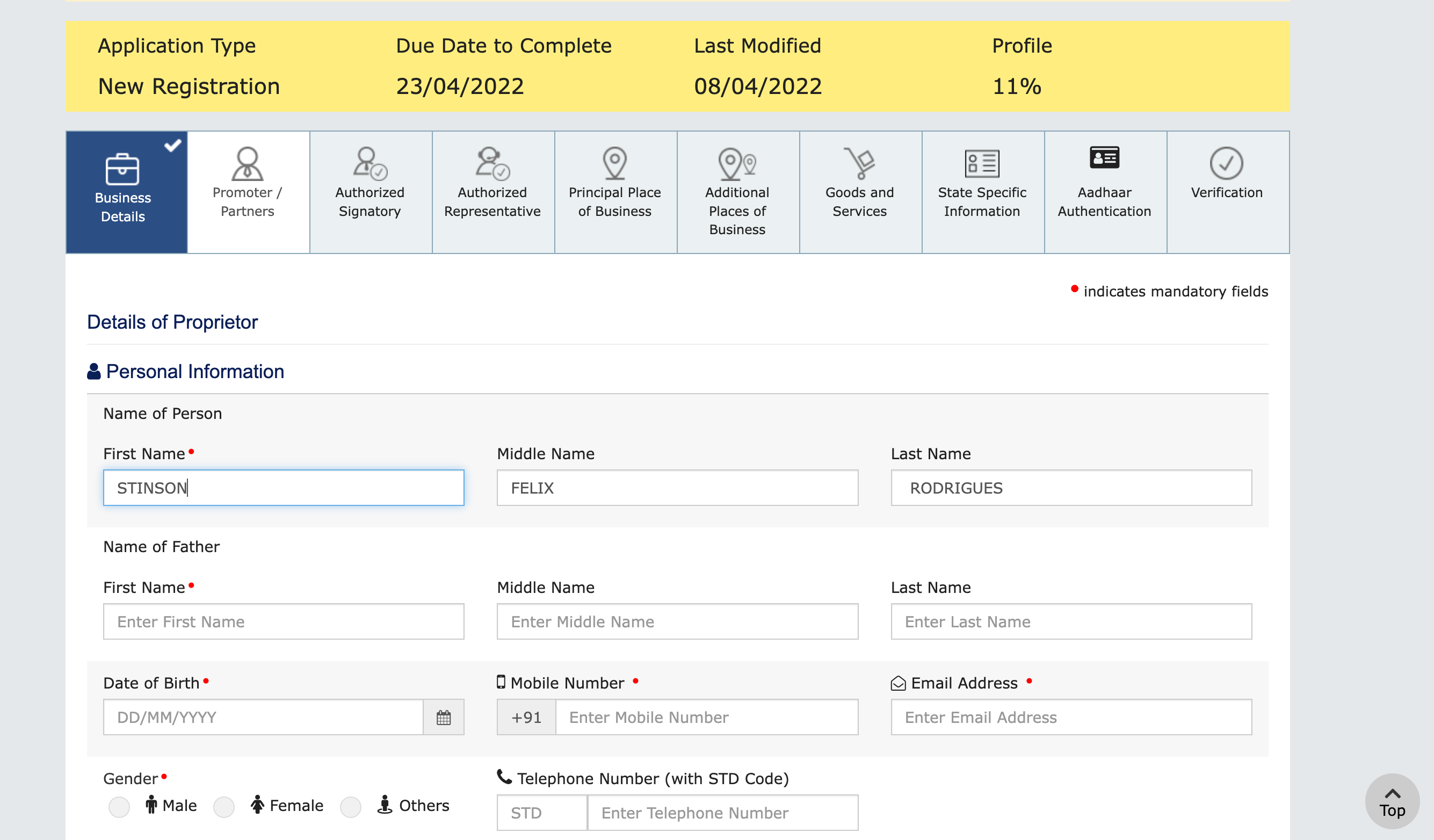

Step 6: Furnish your business information as requested by the GST portal.

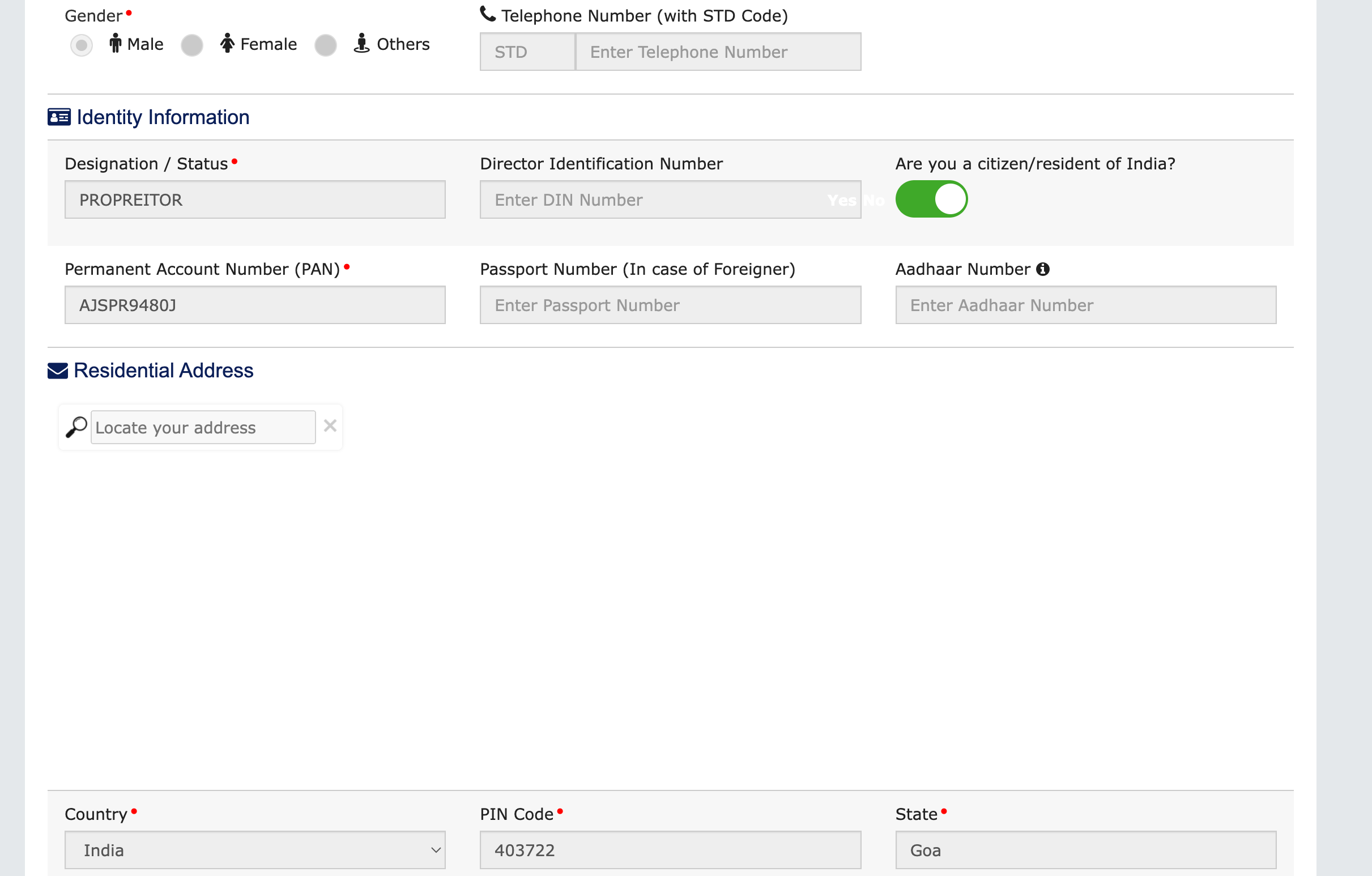

Step 7: Furnish the Promoter’s details. For the proprietorship type of business, the proprietor’s details must be submitted.

Step 8: Provide authorized signatory details for the registration. The said person will be responsible for filing timely returns of the company.

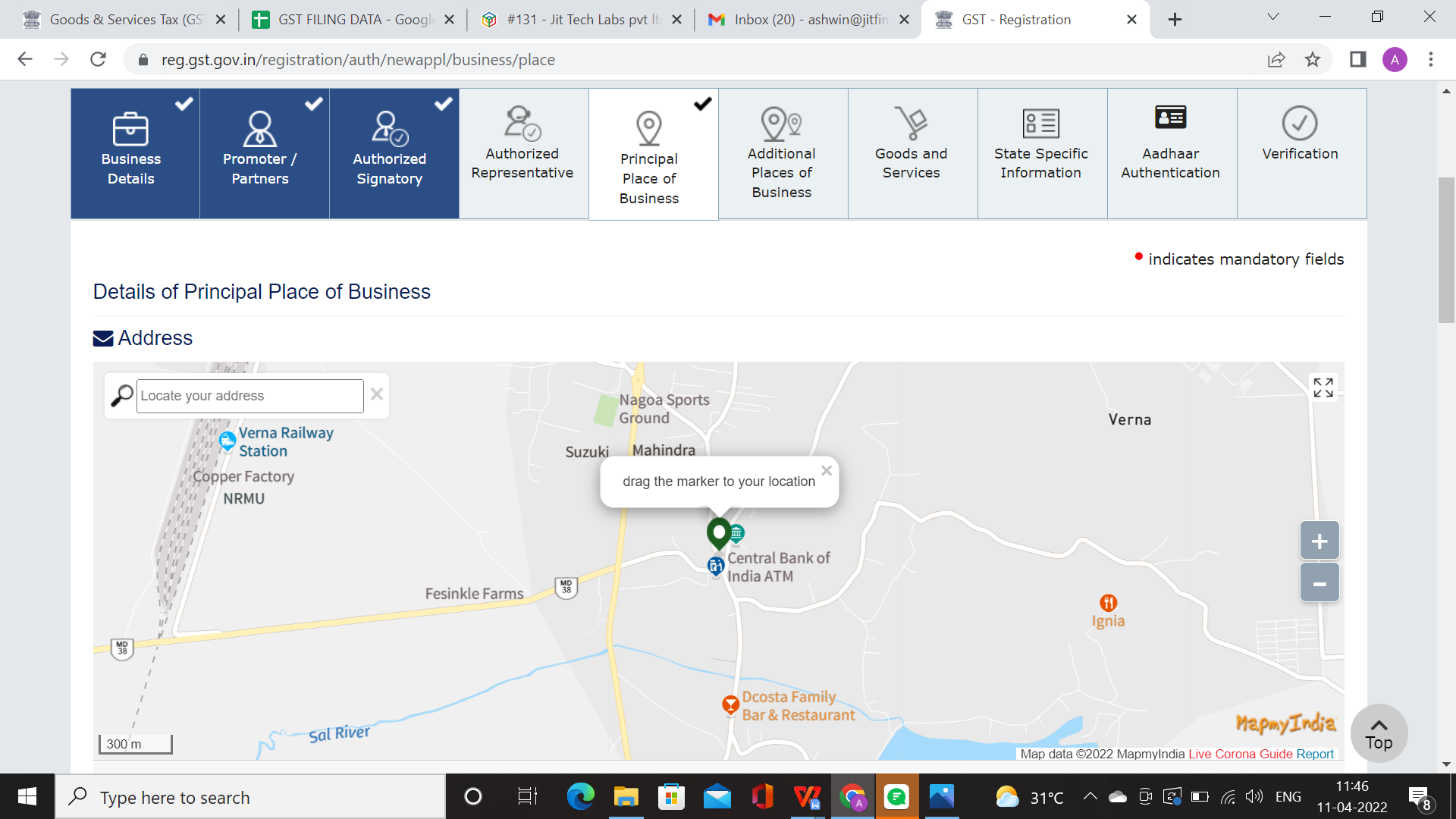

Step 9: Furnish details of your ‘Principal Place of Business’. This shall act as the principal location from where the business would be carried out.

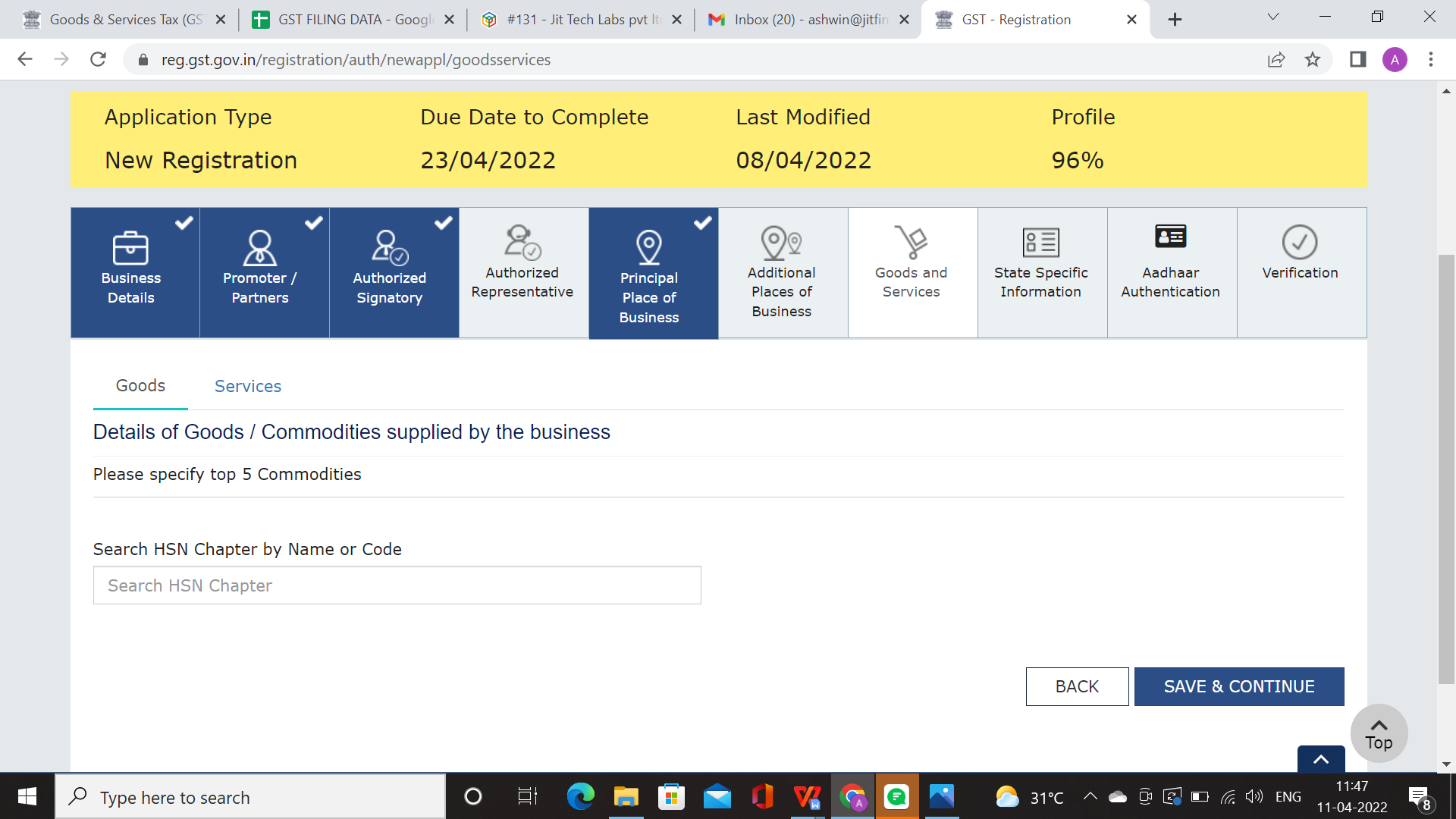

Step 10: Furnish details of goods & services supplied by the applicant.

Step 11: Provide details of your Bank Account.

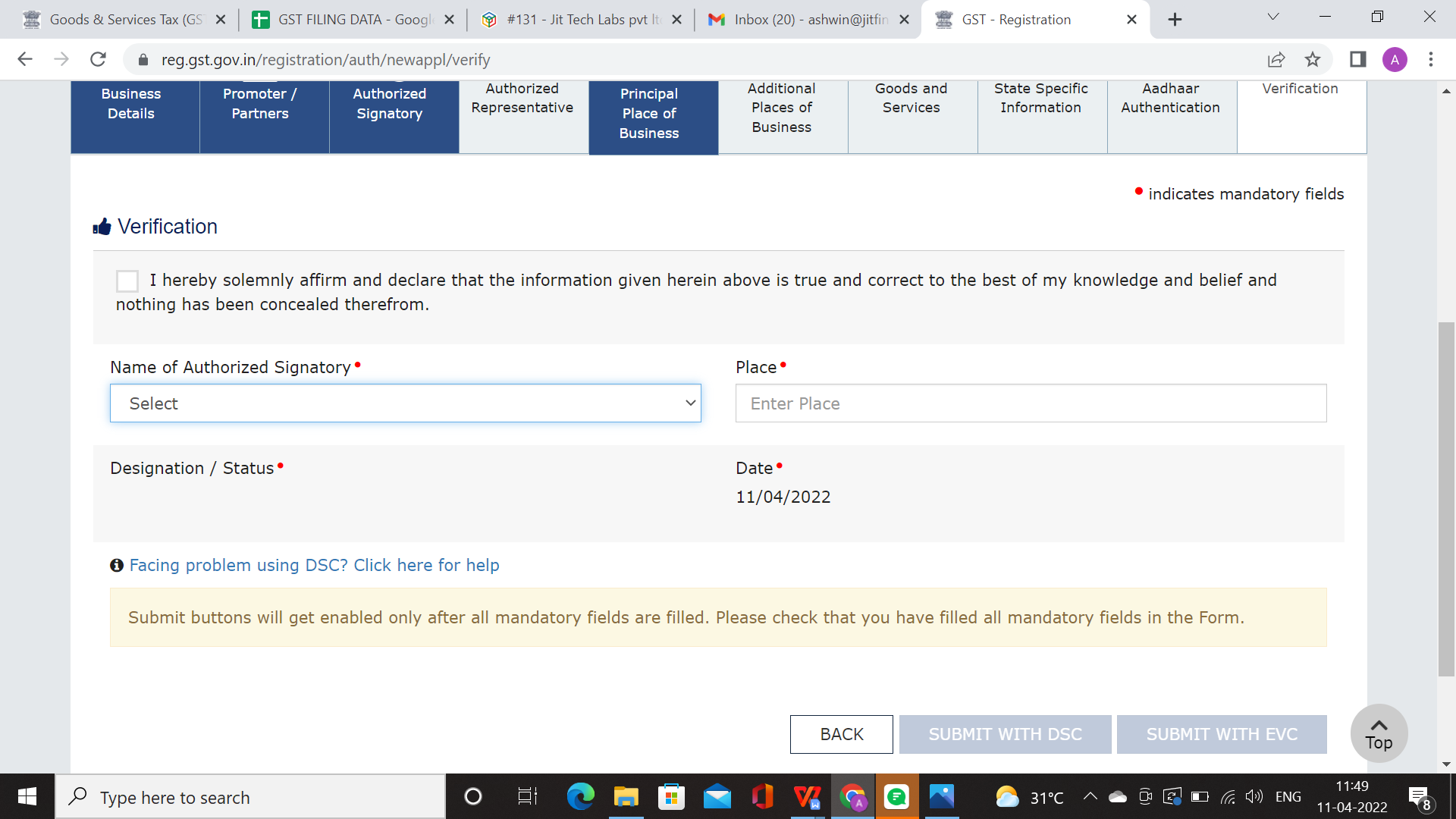

Step 12: Select the verification box once you confirm all the details furnished in the application.

Step 13: Post signing of the registration application, the Application Reference Number (ARN) receipt will be received on the registered Email address.