All-in-one Free GST Software for MSMEs

Know your suppliers. Know your business.

Free yourself from the burden of

GST compliance with KYSS

Automate GST compliance and reduce accounting headaches with KYSS – a powerful tool to track suppliers’ filings, complete GST reconciliation and generate e-invoicing & E-way bills. KYSS currently helps MSMEs claim 100% Input Tax Credit on every invoice.

Know your suppliers. Know your business.

Free yourself from the burden of GST compliance with KYSS

Automate GST compliance and reduce accounting headaches with KYSS – a powerful tool to track suppliers’ filings, complete GST reconciliation and generate e-invoicing & E-way bills. KYSS currently helps MSMEs claim 100% Input Tax Credit on every invoice.

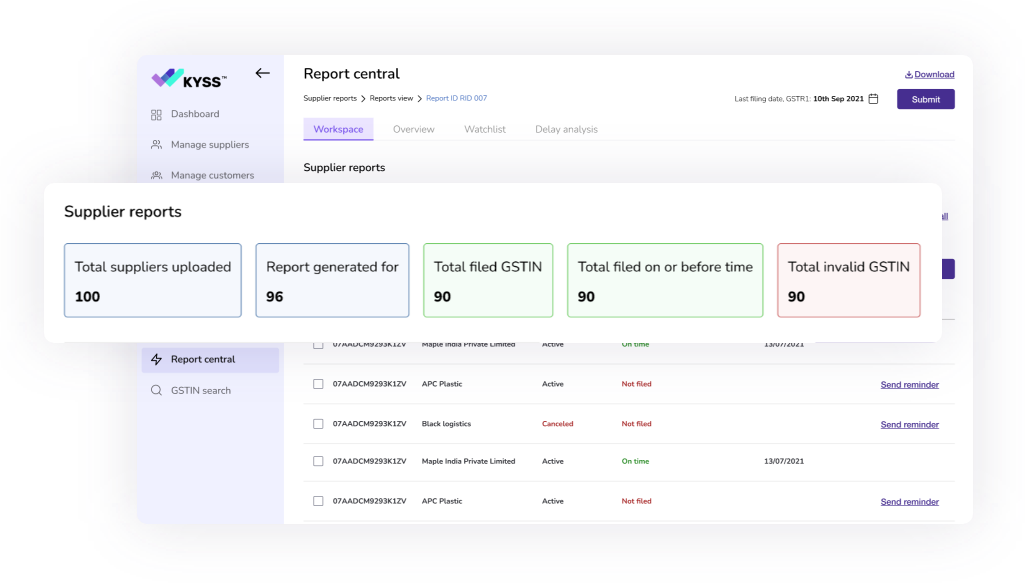

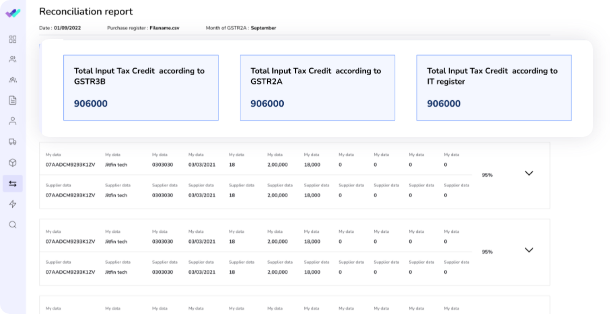

Track Supplier GST Filings

Save time, energy and money by getting real-time GST filing information of your suppliers to keep track of your tax compliance.

Track Supplier GST Filings

Save time, energy and money by getting real-time GST filing information of your suppliers to keep track of your tax compliance.

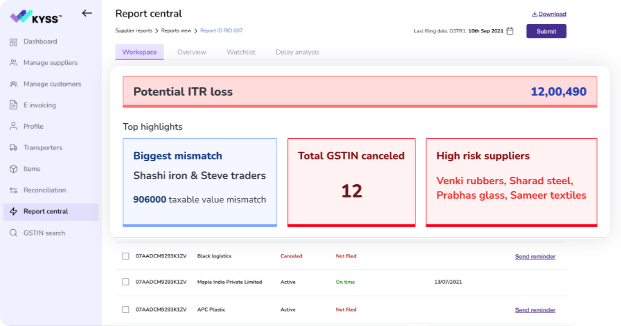

Reconcile GST Transactions

Speed up the GSTR-2A reconciliation process and improve the accuracy of claims for ITC, reducing mistakes and errors by 32%.

Reconcile GST Transactions

Speed up the GSTR-2A reconciliation process and improve the accuracy of claims for ITC, reducing mistakes and errors by 32%.

Claim Full Input Tax Credit

Seamlessly claim 100% input tax credit on every transaction. Lower your tax liability, reduce administrative burden and increase your profitability.

Claim Full Input Tax Credit

Seamlessly claim 100% input tax credit on every transaction. Lower your tax liability, reduce administrative burden and increase your profitability.

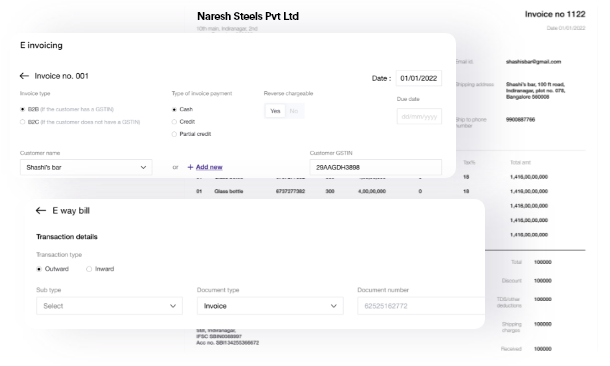

Design custom E-Invoices and E-way Bills

Create GST compliant invoices using KYSS. Capture HSN Codes and generate E-invoices and send them to your customers via WhatsApp/Email.

Design custom E-Invoices and E-way Bills

Create GST compliant invoices using KYSS. Capture HSN Codes and generate E-invoices and send them to your customers via WhatsApp/Email.

All the features you will need to manage your GST transaction better

The best, simplest and most affordable GST Software in the market

100% Input Tax Credit

Increase tax-saving potential and complete Input Tax Credit on every matched invoice.

100% Accurate

Multiple layers of validation per invoice and GST report. Get accurate GSTIN validations for suppliers.

360º View of Recon Reports

Visual and actionable summary reports for GST reconciliations.

Supplier Tracking & Watchlists

Create watchlists for specific suppliers to get updates on their GST filing activity.

Supplier Filing Delay Analysis

Identify companies based on Delay criteria.

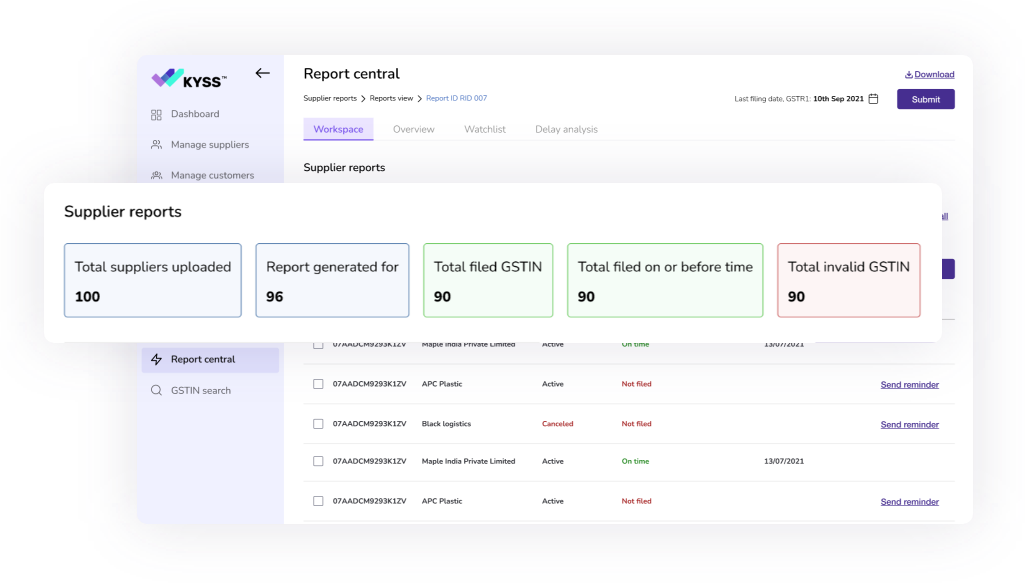

Supplier Risk Analysis

Check GST-based risk profiles of all your suppliers.

Generate E-Invoices & E-Way Bills

Create one or bulk GST compliant invoices and E-way bills.

Integrated GSTN Search

Search for any GSTIN and get a complete compliance report on the dashboard.

Smart Reports

AI-powered analytics for a holistic view of Supplier and invoicing data.

Faster Experience

Save countless man-hours per GST report every month.

Supplier Segregation Tool

System generated buckets for suppliers’ GST filing and compliance patterns.

View of Potential ITR Loss

Prescriptive analysis of ITR loss from supplier compliance or mismatch data.

Easy to Get Started

Sign up with KYSS in just 30 seconds to get started. Access online, no installations are needed.

AI-powered Matching for Recon

Match one or bulk invoices within minutes.

Testimonial

Our product is loved by many MSME business owners

Our product is loved by many MSME business owners

FAQs