GST Input Tax Credit is a concept that is most essential for a business under the GST regime. However, there are many instances where the businesses need to be extra cautious while utilizing their Input Tax Credit.

Businesses can claim the unutilized ITC under GST after satisfying certain conditions and has to furnish the ITC refund details in the Form RFD-01.

In this comprehensive article, we will look at the basic details of the ITC refunds and also explain the steps in easy way to claim the ITC refund for your unutilized ITC.

What is unutilized ITC under GST?

Input Tax Credit under SGT remains unutilized or accumulated when the tax paid on the inward supplies EXCEEDS than the outward GST liabilities. This extra credit CAN be carried out to the next Financial Year.

After this carry forward of the ITC, the registered taxpayer can utilize the ITC for the payment of outward GST liability.

Under GST laws,

ITC Refunds are allowed in the following cases:

- Zero-rated supplies are made without payment of GST

- In case of Inverted Duty Structure in the business

- Supplies made to SEZ (Special Economic Zones) units without the payment of GST tax

- Export of goods or services made without payment of GST by issuing Letter of Undertaking or Bond.

e. On purchases of goods or services made by the foreign embassies or international organizations in India.

ITC Refunds are NOT allowed in the following cases:

a. If Goods exported out of India are attracting Excise Duty, then the unutilised ITC will NOT be eligible for the GST Refund.

b. For inverted tax structure if output is nil rated or exempted from GST.

When can a taxpayer claim the Refund of unutilized ITC?

Section 54(3) of the CGST Act of 2017 states that a GST registered person may claim GST refund of unutilized Input Tax Credit at the end of the tax period.

The application should be made via FORM RFD-01 within TWO years from the relevant date.

Steps to claim ITC Refund

Applying for ITC Refunds is a very simple process provided that the taxpayer has fulfilled the mandatory requirements for ITC refunds claim.

Follow the steps mentioned below to submit your ITC claim:

Step 1: Apply for your GST Refund on the GST portal

Log in to the GST portal using your registered credentials.

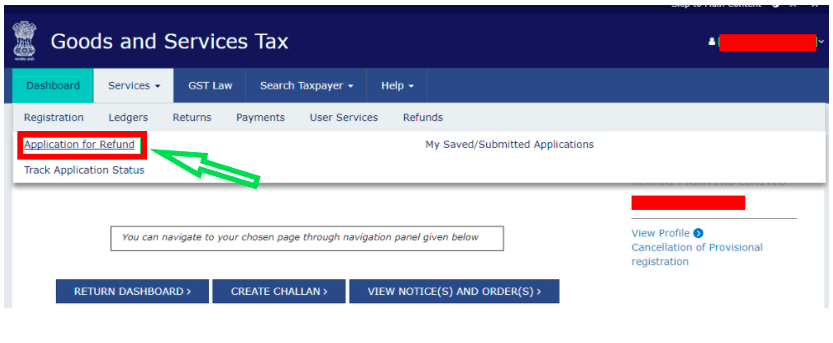

Navigate to the Services >> Refunds >> Application for Refund

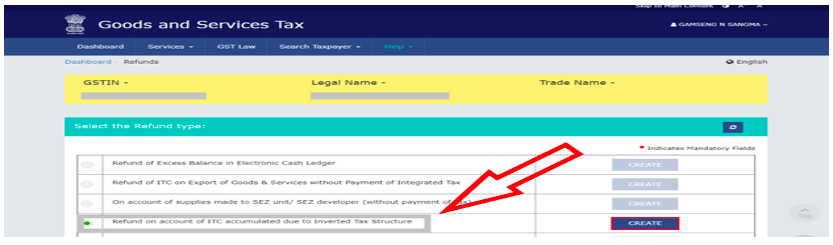

Step 2: Select the Refund Type from the options available

Different Refund Types are displayed on this page. From these options, select ‘Refund on account of ITC due to inverted tax structure’.

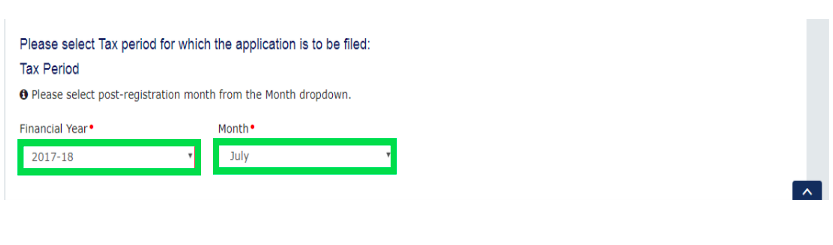

Step 3: Select the tax period for the Refund claim

Taxpayers should select the tax period for which the refund application is being filed.

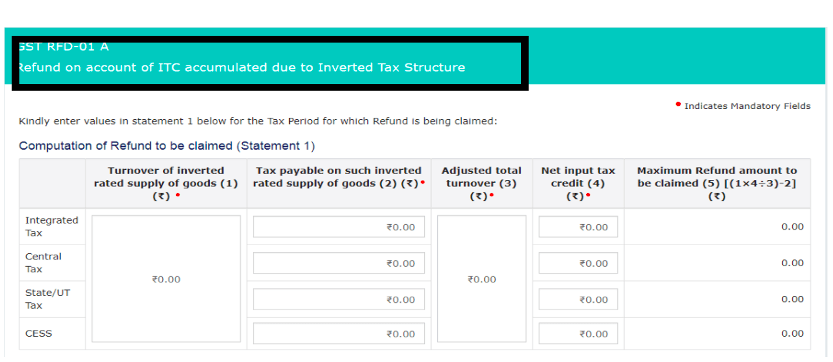

Step 4: Computation of ITC accumulated

Taxpayers have to furnish the GST tax details in this table.

Please ensure that the data to be entered here is valid and verified.

The details to be furnished in the table are explained below:

| Sr. No | Column Name with No. | Description |

| 1 | Turnover of inverted rated supply of goods (1) | Refer to column-3.1(a) of the Form GSTR-3B to enter the turnover of inverted rated supply of goods |

| 2 | Tax payable on such inverted rated supply of goods (2) | Details of taxes payable under four major heads – IGST, CGST, SGST / UTGST, and CESS |

| 3 | Adjusted Total Turnover (3) | enter the adjusted value |

| 4 | Net Input Tax Credit (4) | provide the net ITC under the IGST, CGST, SGST/UTGST, and Cess |

| 5 | Max amount to be claimed | Details of this column will be auto- computed |

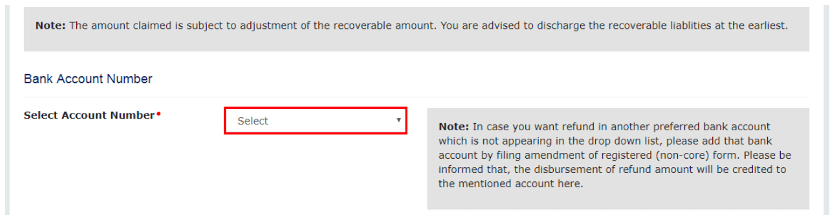

Step 5: Furnish your bank details

Select the preferred bank account number from the ones registered with the GST portal.

Please provide valid details as the refund will be credited in the same account.

NOTE: taxpayers are advised to save the refund application using the ‘Save’ button to save the details furnished in the application.

Check the ‘Declaration’ box at the end of your application.

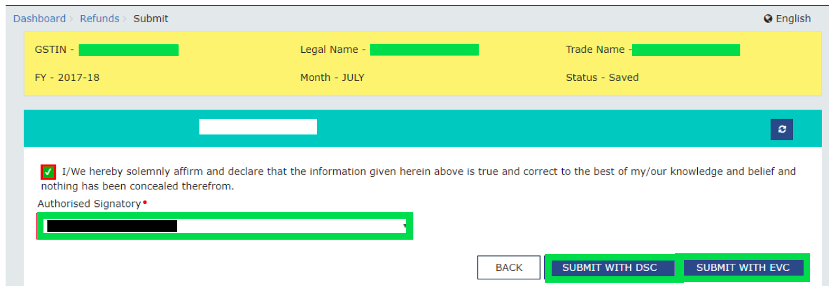

Step 6: Digitally sign your refund Application

After furnishing all the required details for processing the refund, taxpayers need to digitally sign the refund application using the EVC or the DSC option.

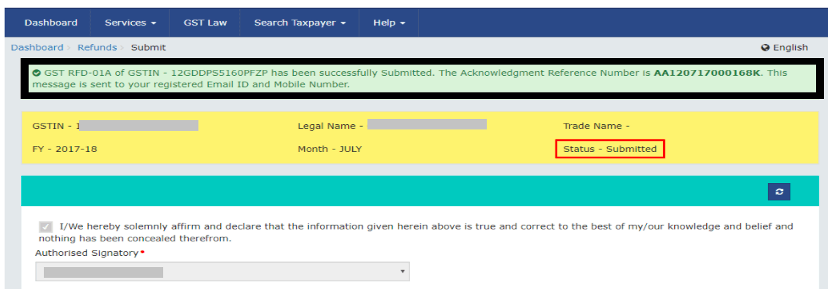

Step 7: Get the ARN Receipt

ARN stands for Acknowledgement Reference Number (ARN) that is a unique number assigned to your refund request.

After digitally signing the application, you’ll see a ‘Success’ message & the status of your application will be changed to ‘Submitted’.

The ARN receipt can be downloaded in the PDF format.

The ARN receipt is important because the taxpayer has to submit this receipt with all the documents to the Proper Officer.

How is Refund Amount Calculated?

There is a maximum limit to claim the inverted tax credit.

Rule 89 sub rule (4) of the CGST Rules of 2017, explains the formula for computing the Refunds of unutilized Input Tax Credit payable on account of the zero-rated supplies that are made without payment of GST.

The maximum amount allowed for the Refund claim is calculated based on the formula given below:

Maximum Refund Amount = (Turnover of inverted rated supply of goods X Net ITC / Adjusted total turnover) – (Tax payable on this inverted rated supply of goods)

Let us understand the meaning of each term in easy words:

| Term | Description |

| Refund amount | maximum GST refund allowed |

| Net ITC | Input Tax Credit that was availed on the input services during that period |

| Turnover of inverted rated supply of goods | Total value of inverted supply of goods made during the relevant period without the payment of tax |

| Tax paid on inverted rated supply of goods | Total tax paid on the inverted rated supply of goods |

| Adjusted total turnover | Specify the turnover in a State/UT as defined in

clause (112) of section 2 of CGST Act, excluding the exempted supplies other than the inverted-rated supplies during the tax period |

Input Tax Credit claims are easier with automated solutions

Claiming 100% Input Tax Credit is difficult if a business has multiple GST registration under a single PAN.

Hence, businesses are advised to use automated ITC reconciliation platforms like KYSS.

The automated GST filing solutions like KYSS allows you to:

- Hassle-free GST return filing.

- Automated reconciliations to identify errors and file 100% accurate GST returns.

- Claim 100% eligible GST Input Tax Credit and stay away from the ineligible ITC under GST.

- Identify the defaulting GST suppliers by uploading supplier data in bulk.

- Generates a comprehensive report and sends them to the concerned stakeholders.

- Automated notifications to the identified GST defaulting supplier.

- Authentic GST data – directly fetched from the GSTN portal.

- Frequent follow-ups – The automated tracker works on data-driven insights. Hence, for a non-responsive supplier, regular follow-ups will be scheduled.

This comprehensive article has discussed the basics of ‘What ITC Refund is & how is it calculated’ and the seven step process to claim to claim the GST Refunds.

It’s essential that the businesses use an automated reconciliation and GST return filing solution like KYSS so that there is no ambiguity in the GS return filings and you do not have to worry about the ineligible ITC claims.

Claiming ineligible ITC under GST can put your business under the GST department’s radar and lead to GST registration suspension.

In the upcoming article, we will help the readers understand all the Input Tax Credit components in detail

Stay tuned with KYSS for more awesome content on GST!