GST payment can be made either online or offline.

Businesses are required to pay their outward tax liabilities in cash after utilizing the eligible Input Tax Credit. After this, the registered taxpayer should generate a GST Challan before or after logging into the GSTN portal.

Section 49 of the CGST Act of 2017 read in the light of CGST Rules explains the details of the new payment procedures under GST. This article explains the overview of all the GST payment procedures.

In this detailed article, we submit step-by-step instructions for GST Payment online for different types of taxpayers under GST.

GST Payment online Options

GST portal provides multiple options for GST payment online. Following are some of the available options:

- Over the Counter Payments (OTC)OTC payments are made if the amount of GST payable is less than Rs. 10,000.

This amount can be paid with cash, via Cheque or Demand Draft (DD).

If the GST amount payable exceeds Rs. 10,000 then other available options should be used.

- Challan generation

Electronic GST Challan can be generated on the GST portal. The complete guide to generate GST Challan is discussed in the later section.

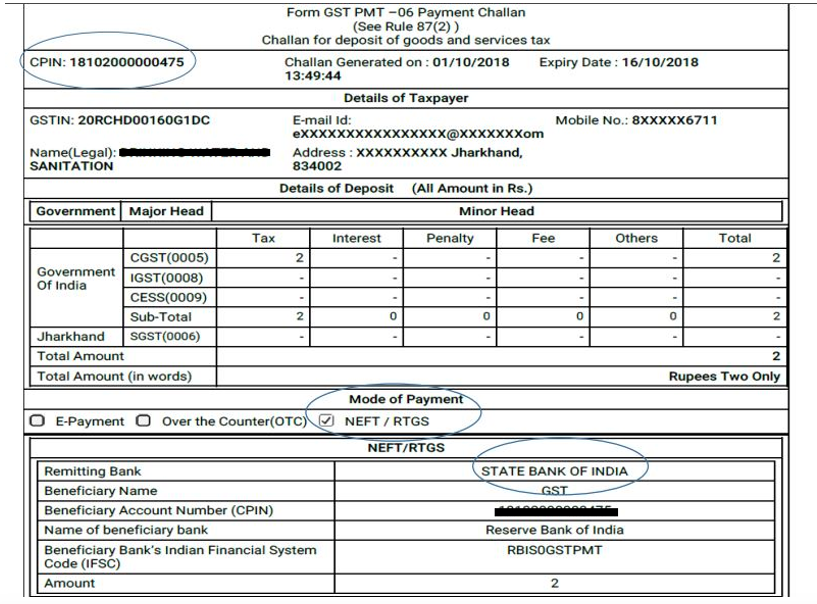

GST Challan has to be generated by filling FORM GST PMT-06.

The validity of this GST Challan is 15 days from the date of generation.

- Online payment through Cards or National Electronic Funds Transfer (NEFT) or Real Time Gross Settlement (RTGS)

- Internet banking through authorized banks

NOTE: A unique Challan Identification Number (CIN) is generated when the GST payment is credited to the concerned Government account.

For every Debit or Credit to the Electronic cash or Credit Ledger a Unique Identification Number (UIN) shall be generated on the common GST portal.

Important terminologies in GST Payment

- What is an Electronic Credit Ledger?

In the GST system, the electronic credit ledger captures the amount of GST Input Tax Credit available to the taxpayer. This electronic credit ledger is to be maintained on the GST portal for each taxable person who can avail eligible Input Tax Credit.

The amount available or the CREDIT available in this electronic credit ledger can be used by the taxpayer to pay off the outward tax liabilities.

Every GST registered person is required to maintain the Electronic Credit Ledger via FORM PMT-02 and furnish details like ITC claimed, ITC utilized, ITC reversed & refund details. - What is an Electronic Cash Ledger?Electronic Cash Ledger is a summary or a database to be maintained by the registered taxpayer on the common GST portal, which captures cash available to pay off your outward GST liabilities.

The details are to be furnished to the Electronic Cash ledger via FORM GST PMT-03.

The cash available in the Cash Ledger is further r used to make payments like outward liabilities, GST penalties and interests or any other amount payable.

- What is an Electronic Liability Ledger?

Electronic Liability Ledger captures the total outward GST liabilities and the modes through which these liabilities are paid. This ledger shows the amount of tax due, interest, penalty, late fees & other amount payable.

GST Challan generation – How to generate GST Challan on GST Portal

Taxpayers can generate a GST Challan in two ways:

- By logging in to the GST portal

Following are the steps to follow to generate GST Challan by logging in to the GST portal:

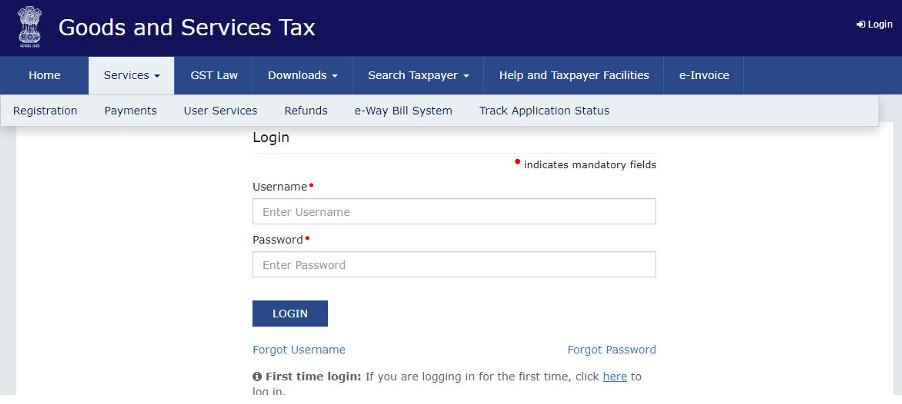

Step 1:Log in to your GST portal using your login credentials.

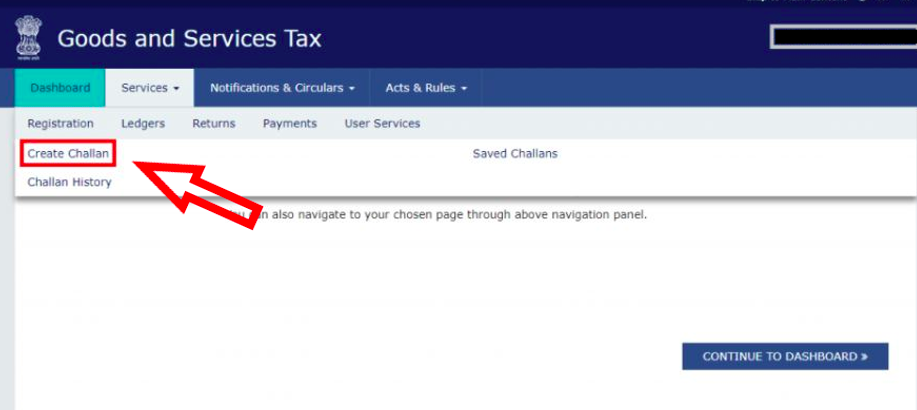

Step 2:Go to your dashboard to Services >> Create Challan

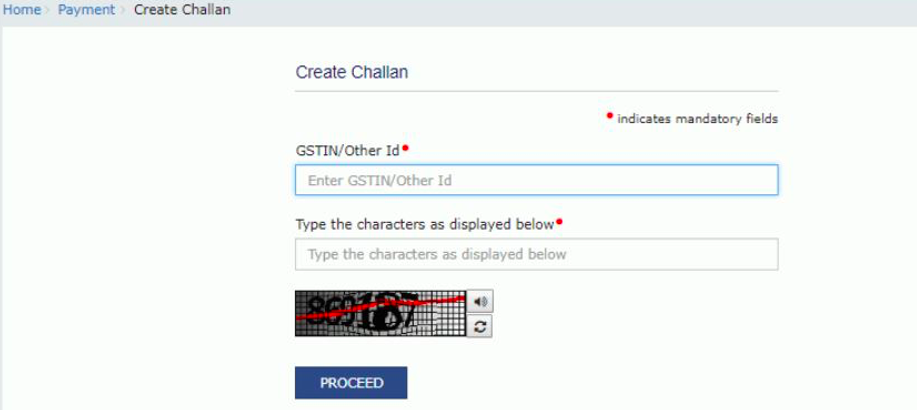

Step 3:Enter the GSTIN as prompted:

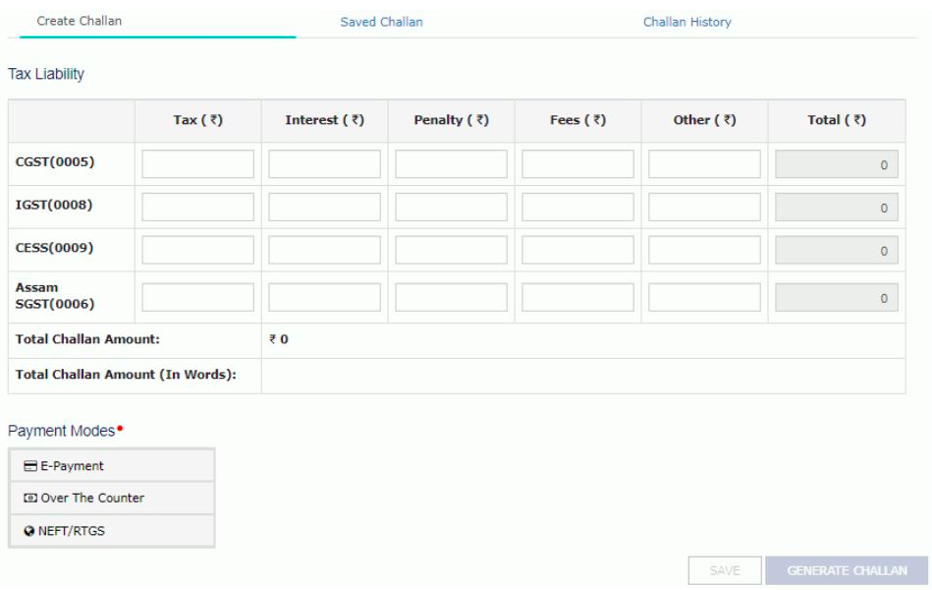

Step 4:Enter the GST amount details under the different heads as specified:

After filling all the GST amount details, you are required to choose the payment mode.

Step 5:

You will now be prompted to enter the GSTIN Id for the final Challan generation:

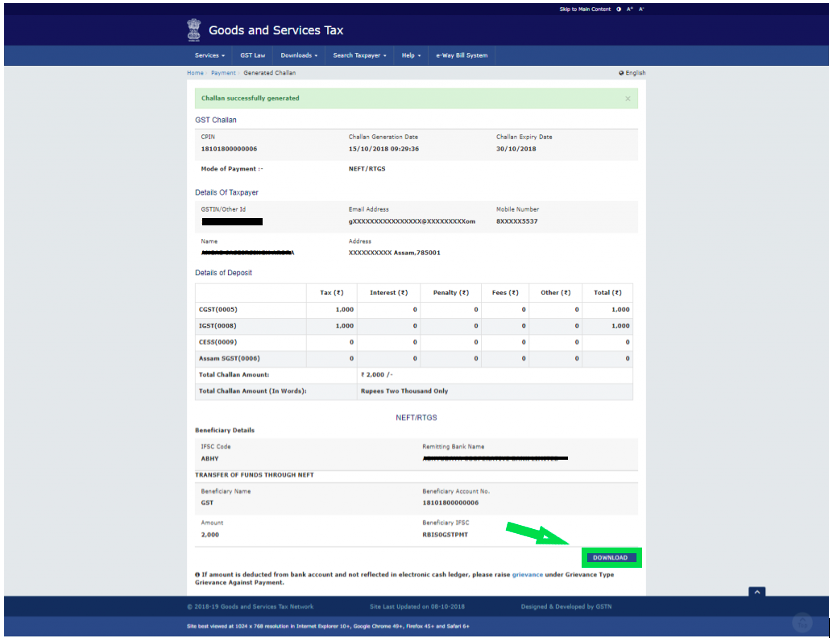

You can download the GST Challan after the preview.

The GST Challan looks as follows:

- Steps to generate GST Challan without login into GST account

Step 1:

On the GST portal homepage, move to Services >> Payments >> Challan option

Step 2:

The GST registered user should enter the GSTIN ID.

The temporary taxpayer is required to enter the ‘Temporary Identification number’.

NOTE: For a temporary or a non-registered entity, a temporary identification number is generated on the common GST portal for the purpose of GST Challan.

Step 3:

Now enter the GST amount details under different heads like CGST, SGST, IGST.

On the same page, choose the mode of payment for the GST Challan generation.

Step 4:

Enter the GSTIN to proceed and preview the GST Challan.

Step 5:

Click on the Download button to create a GST Challan copy for your reference.

Essential GST Payment Forms

Following are some of the important GST payment forms required for GST Payment online:

| Form no. | Description | Purpose |

| GST PMT-01 | Electronic Liability Ledger | Electronic liability ledger captures outward liability tax, interest, penalty, late fee, or any other amount to be debited |

| GST PMT-02 | Electronic Credit Ledger | To store the details of ITC claimed, ITC available, ITC reversed & GST refunds |

| GST PMT-03 | Refund that has to be re-credited | This form holds the REFUND details. If the amount is debited from the Credit or the Cash ledger then this will be refunded by a scrutiny & order of Proper officer. |

| GST PMT-04 | Errors in electronic credit ledger | Discrepancy in the Electronic Credit ledger, is communicated to a Proper officer through this form |

| GST PMT-05 | Electronic Cash Ledger | To capture the tax, interest or penalty to be paid off in cash |

| GST PMT-06 | Challan for tax deposit | To generate and pay off a GST Challan |

| GST PMT-07 | Application of intimation of discrepancy related to GST payments | This form is used to report the discrepancy where the GST payment amount is debited from the Bank Account of the taxpayer but CIN is NOT generated for this particular transaction OR the CIN is generated but not reported by the bank. |

GST Refunds – When is it applicable?

GST Refunds can be claimed under the following cases:

- Exports of Goods & Services

- When you have accumulated ITC and are unused.

- When you make excess payment than required

- Input Tax Credit accumulation if output goods fall under tax exemption or are nil-rated goods.

GST Refunds – Important notes

When a Refund claim is submitted on the GST portal, the GST portal; calculates each type of tax: SGST, CGST & IGST.

To claim a GST refund, you have to submit the request through an electronic form on the GST portal.

The GST portal shall then verify the details and refund the excess tax amount paid.

The turn-around time of the GST Refund is between two weeks to ten weeks.

To successfully claim a GST refund, Aadhar Authentication is mandatory.

This GST refund amount will be credited to the bank account linked to the PAN of the taxpayer.

If any unutilized ITC is available then it can be distributed between different GST registrations registered under the same PAN details.

GST Payment Rules

For a successful filing of GST Monthly return, taxpayers are firstly required to clear their outward liabilities that are due. If the taxpayer files a GST return without paying the tax dues then it will be considered as an invalid GST return.

In short, a taxpayer is NOT allowed to furnish the GST return for a month without furnishing the GST return of the previous month and clearing all the tax dues.

In case if a taxpayer fails to clear the tax dues, then interest will be applicable on the pending liability amount.

Hence, businesses are required to have automated GST return filing software in place, so that the businesses do not miss out on the GST return filing due dates.

KYSS portal is one such automated GST return filing solution that allows you to file GST return online and protect your businesses from ineligible ITC claims.

The automated GST filing solutions like KYSS allows you to:

- Hassle-free GST return filing.

- Automated reconciliations to identify errors and file 100% accurate GST returns.

- Claim 100% eligible GST Input Tax Credit and stay away from the ineligible ITC under GST.

- Identify the defaulting GST suppliers by uploading supplier data in bulk.

- E-Invoice generation in bulk in just a single click.

- Generates a comprehensive report and sends them to the concerned stakeholders.

- Automated notifications to the identified GST defaulting supplier.

- Authentic GST data – directly fetched from the GSTN portal.

- Frequent follow-ups – The automated tracker works on data-driven insights. Hence, for a non-responsive supplier, regular follow-ups will be scheduled.

In this guide, we have discussed the major facts about the payments online. The steps to generate a GST Challan is also discussed in the article as it is one of the most popular modes of GST payment online. We will keep updating this thread with more information under the GST realm.