The Government is making it mandatory for businesses with a turnover above 5 crores to raise e-invoices. And the easiest way for your business to transition to this change is KYSS, the all-in-one GST platform.

Remember, the consequences of not moving to the right e-invoicing solution can be severe for your business.

For example, If the furnished invoice data is incorrect and identified as non-compliant in the GST audit, you could attract a penalty. Incorrect data due to accounting & clerical mistakes may also hamper your GST Filing.

Generate e-invoices and -way bills in minutes

4 reasons why you should embrace e-invoicing with KYSS

10 free e-invoices per month

KYSS’ free GST solution lets you generate up to 10 free e-invoices per month, enough for many MSMEs.

No tech integration required

KYSS requires no tech integration or implementation. Just register, and you can start using it.

Start in minutes

It doesn’t take hours to set up KYSS. Just 2 minutes and you are off the blocks to be 100% GST compliant.

100% GST Compliant

KYSS is fully compliant when it comes to the latest rules and regulations set by the government.

5 reasons why you need e-invoicing

Keep data ready for filing

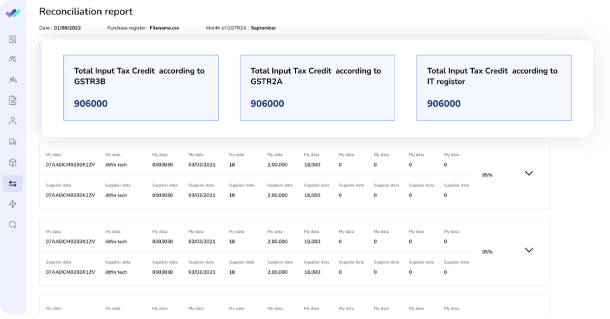

Minimal need for data reconciliation

Quick and accurate reconciliation can reduce mistakes and errors by 32%, and enables efficient claims for input tax credit.

Real-time tracking of invoices

Invoices prepared by suppliers can be tracked in real-time. This can also lead to reduction in input tax verification issues.

Reduction in tax frauds

Better management and automation of the tax-filing process.

KYSS, the all-in-one GST solution

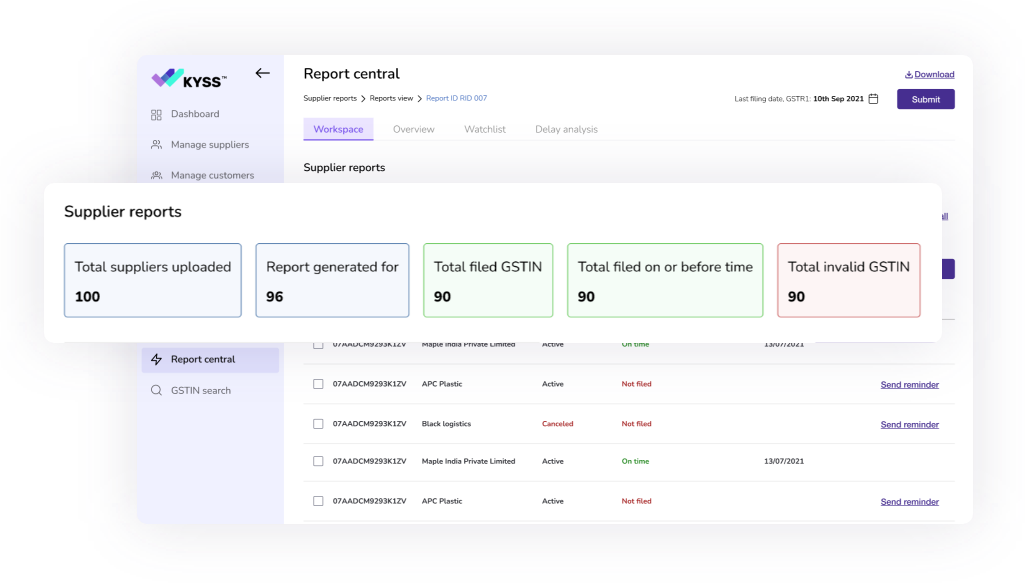

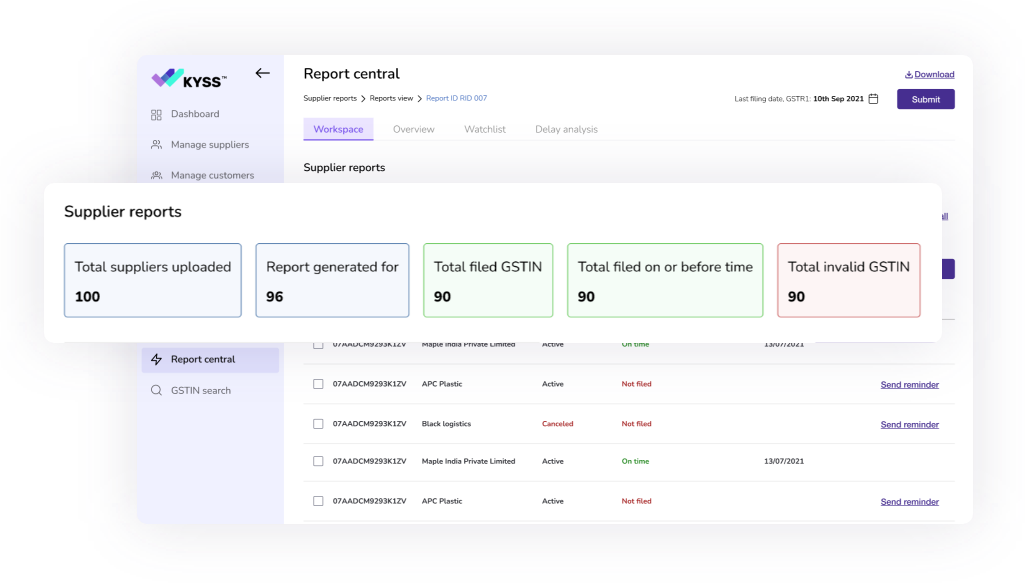

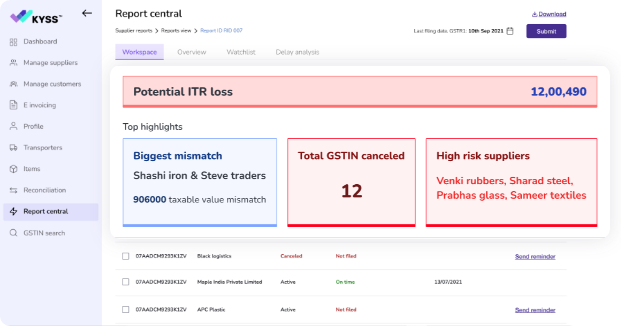

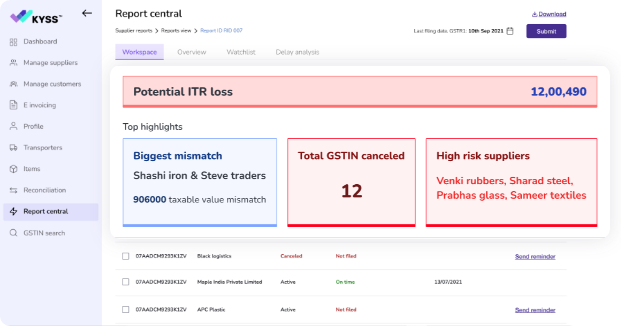

Supplier Tracking

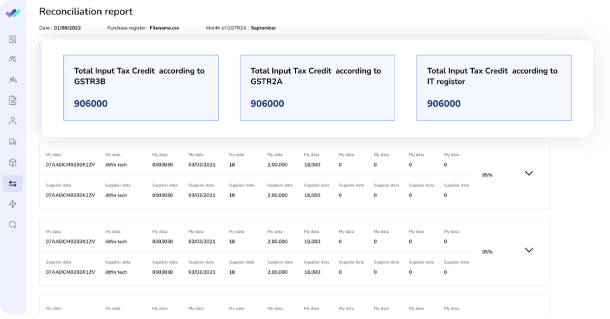

Accurate Reconciliation

Quick and accurate reconciliation can reduce mistakes and errors by 32%, and enables efficient claims for input tax credit.

Full Input Tax Credit

100% compliant and seamless processing ensure you can claim maximum input tax credit on every transaction.

Testimonials

© 2022 KYSS A Product of JiT Finco. All Rights Reserved.